Blog

Since days when shale oil and gas technologies were discovered, the U.S. energy industry has been evolving more rapidly than ever before. Many changes are amazing especially when you put them on an industry map. At Rextag not only do we keep you aware of major projects such as pipelines or LNG terminals placed in service. Even less significant news are still important to us, be it new wells drilled or processing plants put to regular maintenance.

Daily improvements often come unnoticed but you can still follow these together with us. Our main input is to “clip it” to the related map: map of crude oil refineries or that of natural gas compressor stations. Where do you get and follow your important industry news? Maybe you are subscribed to your favorite social media feeds or industry journals. Whatever your choice is, you are looking for the story. What happened? Who made it happen? WHY does this matter? (Remember, it is all about ‘What’s in It For Me’ (WIIFM) principle).

How Rextag blog helps? Here we are concerned with looking at things both CLOSELY and FROM A DISTANCE.

"Looking closely" means reflecting where exactly the object is located.

"From a distance" means helping you see a broader picture.

New power plant added in North-East? See exactly what kind of transmission lines approach it and where do they go. Are there other power plants around? GIS data do not come as a mere dot on a map. We collect so many additional data attributes: operator and owner records, physical parameters and production data. Sometimes you will be lucky to grab some specific area maps we share on our blog. Often, there is data behind it as well. Who are top midstream operators in Permian this year? What mileage falls to the share or Kinder Morgan in the San-Juan basin? Do you know? Do you want to know?

All right, then let us see WHERE things happen. Read this blog, capture the energy infrastructure mapped and stay aware with Rextag data!

Rockies Overview by Rextag: Green River, Powder River, Niobrara-Denver Julesburg, Piceance, Uinta, San Juan, Paradox Basin, Wyoming, Colorado, Utah, New Mexico

New Mexico leads the Rockies region in gas production and ranks as the sixth-largest in terms of active gas wells in the U.S. Last year, the state's gas well count slightly increased by 0.2% to 30,699, with new additions in both the northwestern San Juan Basin and the southeastern Permian Basin. Meanwhile, just to the north in Colorado, gas producers grew by a modest 0.1% to 30,322, primarily due to increased drilling activity in the DJ and Piceance basins. Wyoming saw a decline in its active gas wells by 3.7%, down to 17,006, with production mainly in Sublette, Sweetwater, and Converse counties reflecting stable or slightly reduced drilling activity. Utah also experienced a slight decrease of 0.2% in its number of gas wells, totaling 6,463. In Q1 2024, oil and gas industry activity in Oklahoma, Colorado, and northern New Mexico experienced a decline. This marks the fifth consecutive quarter of contraction in drilling and business activities within these regions. According to a survey that included responses from 33 firms operating in the Rockies, this downtrend is expected to continue over the next six months.

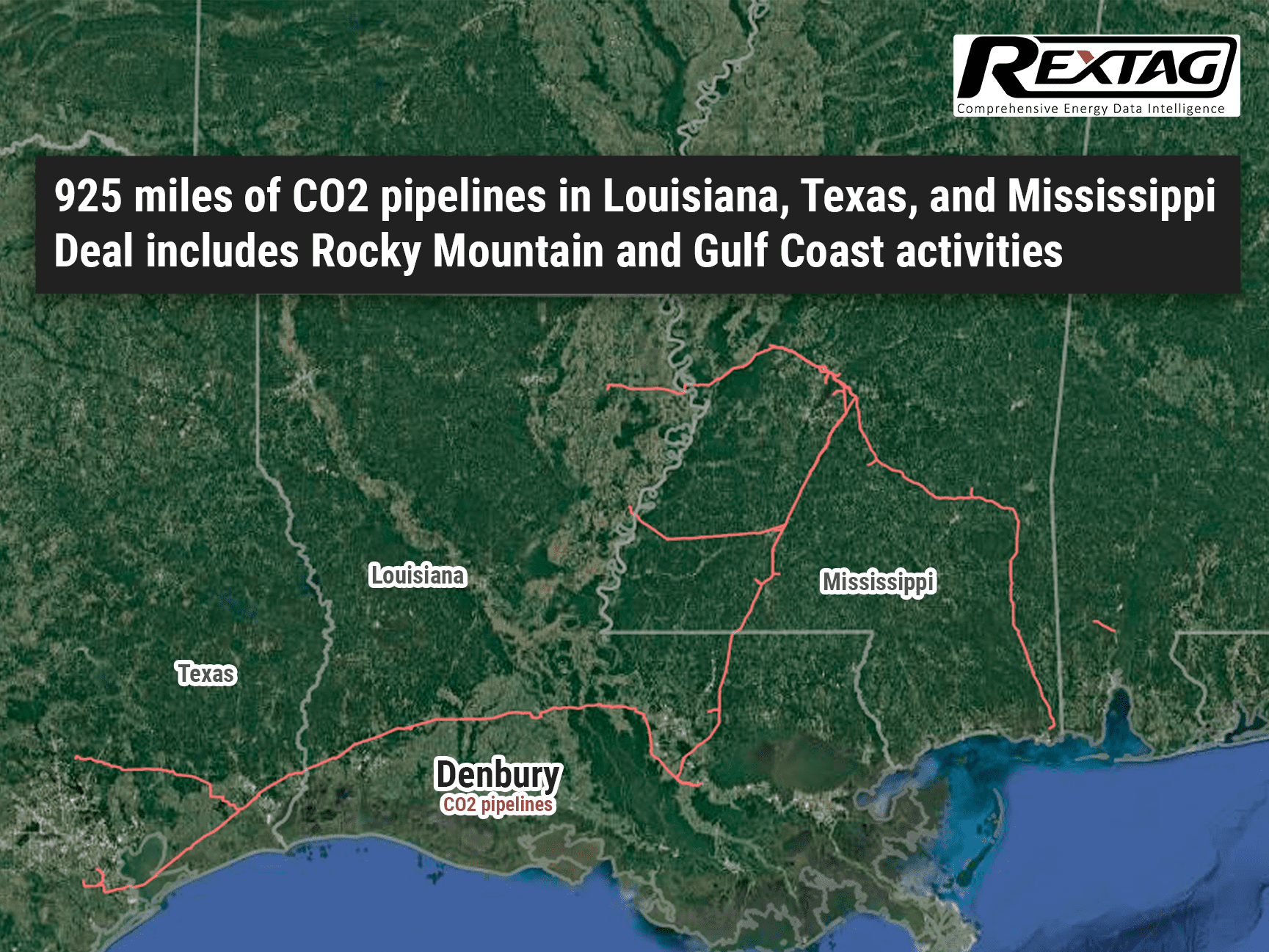

ExxonMobil Acquires Denbury and Enhances carbon, capture, and storage efforts

ExxonMobil's joined assets speed up their Low Carbon Solutions business, offering better decarbonization options for customers. ExxonMobil's top CCS network supports their commitment to low carbon value chains, like hydrogen and biofuels. The transaction synergies will cut over 100 MTA of emissions, leading to strong growth and returns. Exxon Mobil Corporation revealed that it will acquire Denbury Inc., a company specializing in carbon capture, utilization, and storage (CCS) solutions and enhanced oil recovery. $4.9 billion deal will be completed through an all-stock transaction. Darren Woods, Chairman and CEO said “Acquiring Denbury reflects our determination to profitably grow our Low Carbon Solutions business by serving a range of hard-to-decarbonize industries with a comprehensive carbon capture and sequestration offering”.

Williams Buys MountainWest Pipeline System for $1.5 Billion

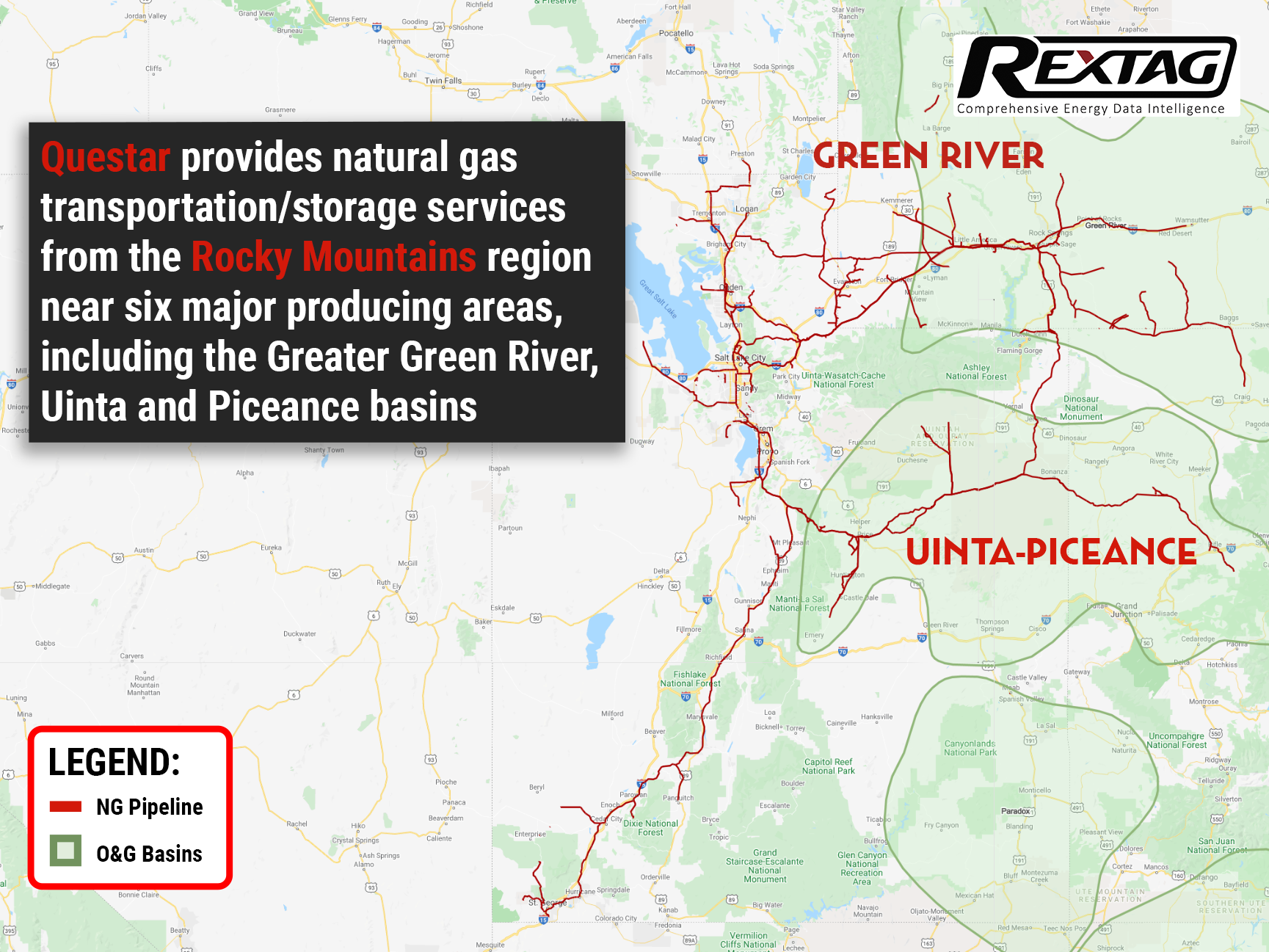

On December 15, Pipeline giant Williams made a deal to purchase MountainWest Pipelines Holding Co. from Southwest Gas Holdings Inc. for almost $1.5 billion including debt. Williams is paying $1.07 billion in cash and assuming $0.43 billion of debt to buy MountainWest, which comprises approximately 2,000 miles of interstate natural gas pipeline systems mainly situated across Utah, Wyoming, and Colorado.

A $2 billion deal saw Dominion Energy sell Questar Pipelines to Southwest Gas

A good asset will not sit on the market for long. After a deal with Berkshire Hathaway fell through, Dominion Energy managed to secure another one for Questar Pipelines in a drop of a hat. And get that, it is better than the former one by more than half a billion! Although not everyone is happy with such decisions, it seems that even Carl Icahn’s complaints won't be able to sway Southwest Gas Holdings’ decision. Though we will have our eyes peeled in any case… If everything goes as planned, a $2 billion deal will be closed before the end of the year.

.png)